ONESOURCE FOREIGN-TRADE ZONE SOFTWARE

Boost operational efficiency and cost savings

Enhance your global trade operations with seamless FTZ management, optimising supply chain processes for industries like automotive, manufacturing, apparel, and pharmaceuticals.

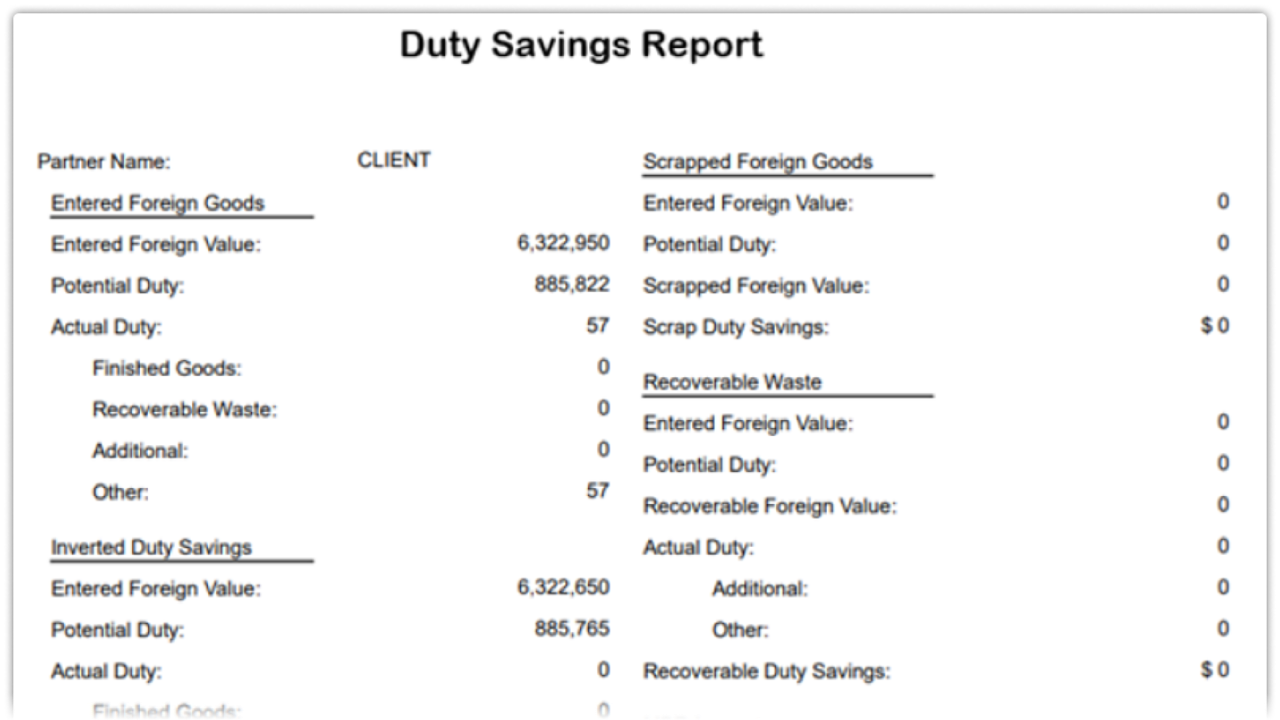

Duty savings

Reduce, eliminate, or defer customs duties with inverted tariffs and duty-free re-exports, maximising cost savings throughout import and export processes.

Improved cash flow

Defer duty payments until goods enter U.S. commerce, enhancing cash flow and reducing immediate financial burdens.

Faster market access

Expedite shipments by bypassing customs delays, enabling quicker inventory turnover and increased competitiveness in global markets.

Lower fees

Cut costs with weekly customs entries and a merchandise processing fee cap, saving thousands annually in administrative expenses.

Smart and secure way of reducing risks and penalties

Automated reporting

Generate required reports for FTZ Board and CBP automatically, saving time and ensuring compliance with warehousing and supply chain records.

Web-based platform

Manage global trade operations seamlessly from one platform, including e-filing of all CBP documentation for efficient processing.

Duty exemption management

Handle re-exports, scrap, and zone-to-zone transfers with ease, leveraging duty exemptions to minimise liability.

Industry-specific solutions

Tailored FTZ management for automotive, apparel, and pharmaceuticals to optimise inventory turnover and regulatory compliance.

Inventory control

Improve inventory management and traceability, leading to shorter cycle times and better supply chain efficiency.

Insurance savings

Reduce insurance premiums by managing inventory within an FTZ warehouse, excluding duty costs from insurable inventory values.

Talk to an expert

Streamline your supply chain and reduce costs with ONESOURCE FTZ management solutions.

Featured resources

Valuing Global Trade automation

How to purchase GTM software

Building the business case for Global Trade Management

Frequently asked questions

Foreign-Trade Zones (FTZs) significantly enhance cash flow by deferring duty payments until goods exit the zone and enter U.S. commerce. This means businesses can maintain their working capital for longer periods, using it for other operational needs rather than tying it up in duty payments. Additionally, FTZs allow businesses to consolidate multiple shipments into a single weekly customs entry, reducing the frequency and cost of merchandise processing fees. This can lead to substantial savings, freeing up funds that can be reinvested into the business for growth and development.

Foreign-Trade Zones (FTZs) software offer a structured framework for managing trade compliance by imposing strict procedures and regulations. Using sophisticated software for inventory control and record-keeping is essential for FTZ operations. This technology allows businesses to maintain accurate records, self-file, and reduce reliance on customs brokers, thereby minimising potential fines and penalties. FTZs also provide a buffer against trade policy volatility, allowing companies to adapt to changing regulations without immediate financial repercussions. By operating within an FTZ, businesses can ensure they meet compliance requirements while benefiting from operational efficiencies and cost savings. For more information, refer to the whitepaper here.

Evaluating the feasibility of setting up an FTZ involves conducting a thorough cost-benefit analysis. Assessing potential savings from tariff reductions against the costs of establishment and compliance is crucial. This includes considering the financial and organizational costs associated with setting up an FTZ, such as deploying appropriate technology and maintaining compliance operations. Additionally, businesses should explore potential local tax breaks at state and city levels, which can offer substantial savings. A detailed feasibility study can reveal the full range of benefits, including customs savings and operational efficiencies, helping businesses determine if the investment in an FTZ is worthwhile.

FTZs impact inventory management by allowing indefinite storage without immediate duty payments, providing flexibility for lengthy manufacturing processes. This enhances inventory accuracy through dynamic bill of materials and traceability systems, ensuring precise records. Improved control leads to efficient operations and reduced waste. In response to sudden tariff changes, FTZs allow businesses to adapt quickly to market demands. Effective management of FTZ operations through technology ensures compliance and optimises supply chains.

Related products

Simplify FTA management and ensure compliance to maximise duty savings and accelerate market access.

Automate and standardise product classification for seamless global trade and reduced compliance risk.

Streamline export workflows, automate documentation, and stay compliant in dynamic international markets.

Experience it for yourself

Streamline your supply chain and reduce costs with ONESOURCE FTZ management solutions.

Have questions? Contact a representative