ONESOURCE Corporate Tax

The direct tax lifecycle, re-imagined!

A tax solution that is purpose built for Malaysian corporations. Save time, with easy set-up.

Enhanced efficiency

Automate your tax workflows, cutting down on manual tasks and saving valuable time.

Enhanced accuracy

Use smart automation to reduce errors, guaranteeing precise tax submissions consistently.

Strengthened compliance

Keep pace with current tax laws, ensuring your company remains compliant effortlessly.

Strategic resource allocation

Allocate more time and resources to focus on strategic initiatives that propel business growth.

Discover a tailored tax solution for Malaysian corporations

Greater agility and scalability

Empower your corporate tax team to work flexibly and securely in the cloud, accessing calculation data anytime, anywhere with a browser and device agnostic web-based platform.

Best-in-class content

Rely on trusted content, built and updated by our in-house specialists to ensure you are tax compliant with the latest tax laws and filing requirements across various jurisdictions.

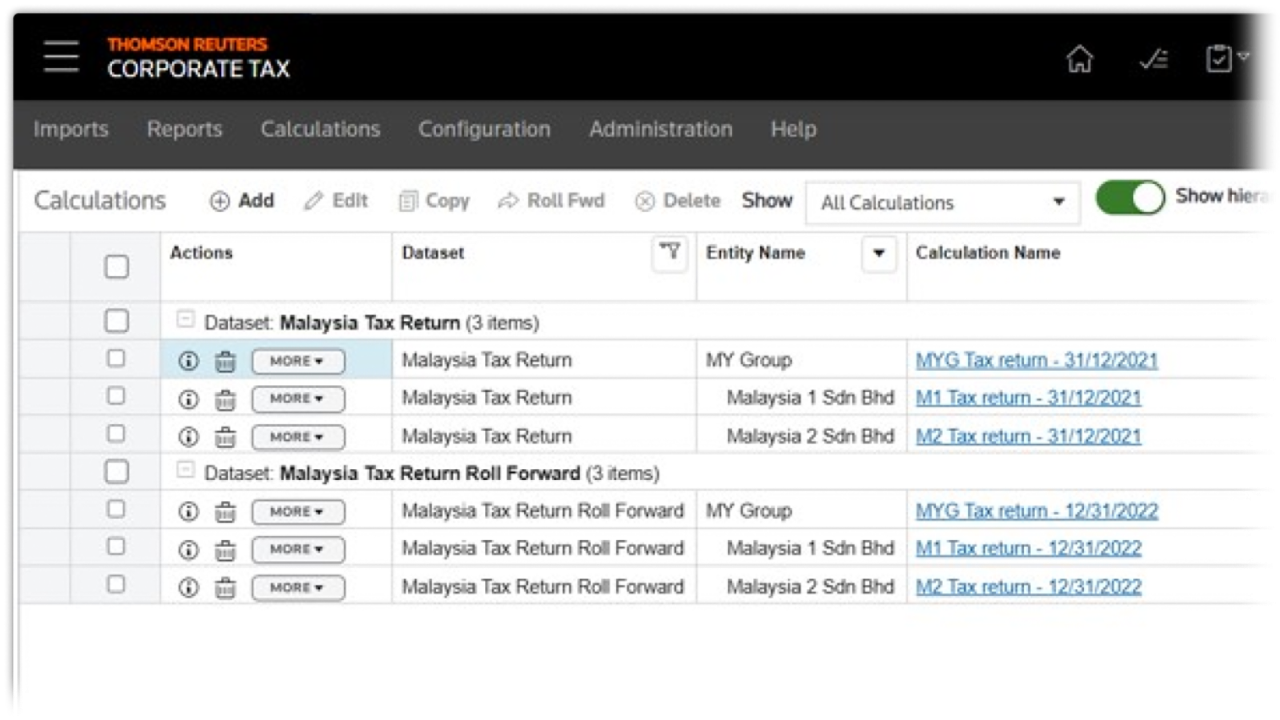

Automatic roll-forward

Easily roll-forward opening balances, customised workpapers, notes, and attachments to the next tax reporting period.

Comprehensive audit trails

Maintain full data traceability from form disclosures to source data, ensuring transparency and accountability.

Local support

With an Malaysia based support desk, access localised support at the speed of business.

Collaborative workflow tools

Use workflow management features to collaborate securely with peers and track user changes efficiently.

Talk to an expert

Streamline your tax operations and enhance accuracy with ONESOURCE Corporate Tax!

What do our customers think?

ONESOURCE works for us because it makes our job easy. My time shouldn't be spent trying to understand how software works...it gives us peace of mind. We're not answering questions all day, we're not spending countless hours trying to file the return [which] should be the easiest thing to do.

Tax Manager – Leading Healthcare Corporation

Featured resources

Entering a New Era: The Future of Corporate Tax Management

ONESOURCE Corporate Tax

Frequently asked questions

Tax software solutions such as ONESOURCE Corporate Tax play a significant role in supporting corporations by automating tax calculations, ensuring data integrity, and maintaining audit trails, which are crucial for meeting the governance and control requirements. By integrating tax technology into processes, corporations can improve their tax governance, reduce risks, and ensure consistent and accurate tax reporting.

To ensure compliance, businesses should keep accurate financial records, understand applicable tax laws, file returns on time, and consider using corporate tax software or professional services for guidance. Conducting regular gap analysis to compare current tax risk measures in line with IRBM expectations can help identify and rectify compliance issues.

Automation in corporate tax processes is essential due to the increasing complexity of tax regulations and the demand for greater transparency and accuracy. Manual processes are time-consuming and prone to errors, diverting valuable resources from strategic tasks. By automating tax workflows, companies can ensure compliance, reduce risk, and improve efficiency. This allows tax teams to focus on value-adding activities, such as strategic planning and analysis, ultimately driving better business outcomes.

Related products

Automate tax provisioning with accurate estimates using intelligent data filtering and drill down capabilities so you can file earlier and close faster.

Workflow software that combines document, data and task management, plus collaboration tools.

Minimize risk and get operationally ready for BEPS 2.0 using cloud-based automation of OECD Pillar 2 tax calculations with rules with rules from 190+ countries.

Ready to transform your tax process?

Streamline your tax operations and enhance accuracy with ONESOURCE Corporate Tax!

Have questions? Contact a representative