ONESOURCE FOREIGN-TRADE ZONE MANAGEMENT FEATURES

Expedite imports & cut customs fees

Store all supply chain data in one location, increase inventory accuracy, and enhance supply chain operations.

Achieve shorter cycle times, increased inventory turnover, and better traceability.

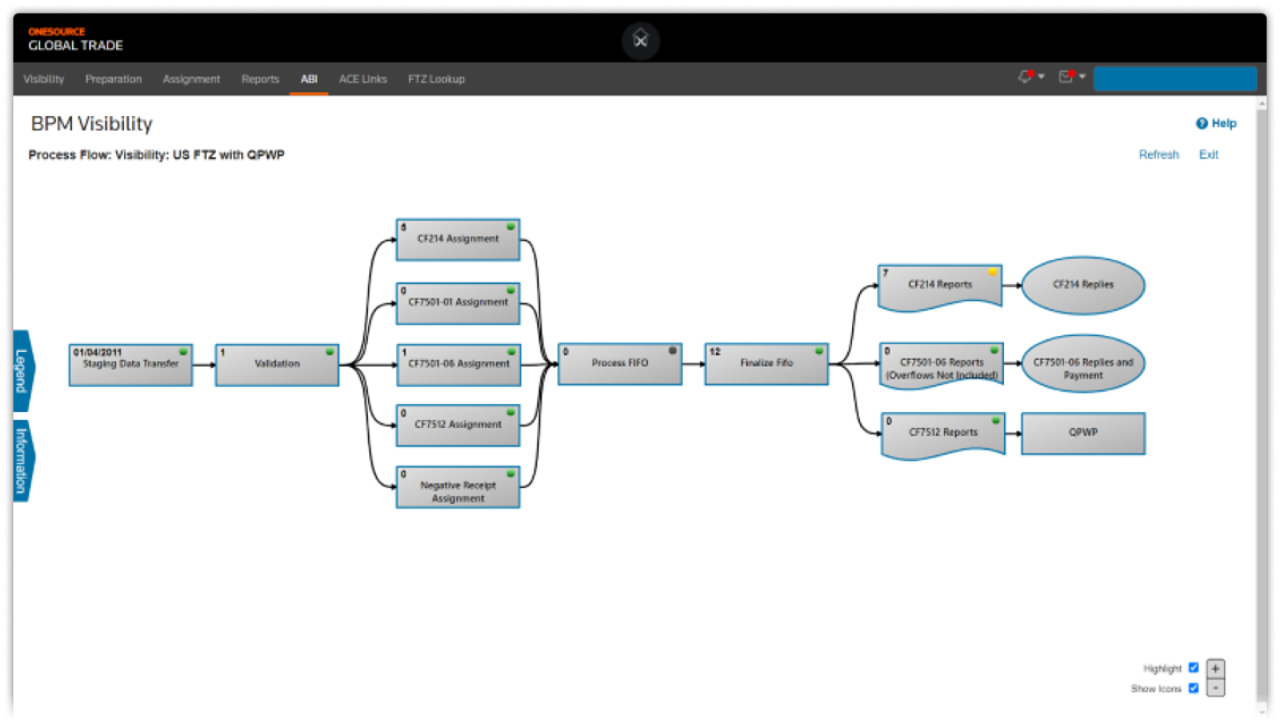

Traceability

Achieve better visibility into your supply chain by leveraging an inventory control and record-keeping system.

Weekly entry filing

Gain faster access to inventory and increased inventory turnover with advanced approval for your merchandise's release from the warehouse into U.S. commerce.

Dynamic BOMs

Utilise dynamic bill of materials (BOM) information to provide a truer process flow and keep inventory counts accurate.

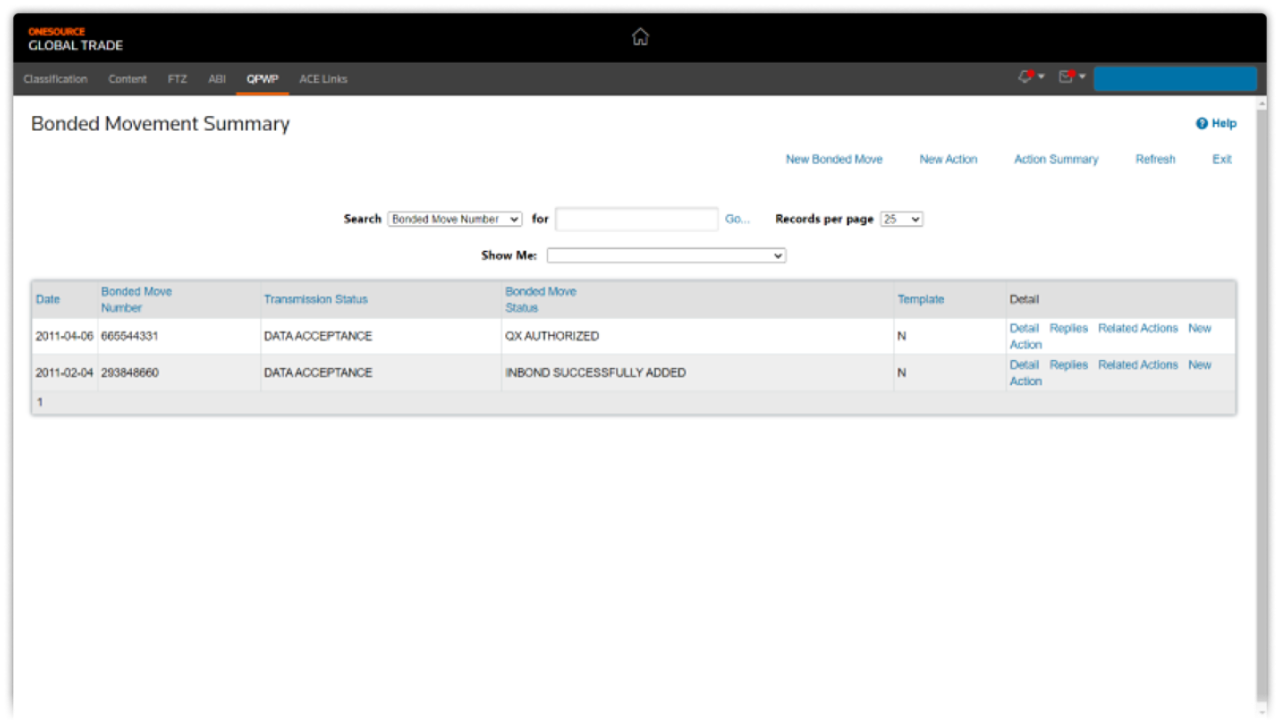

Direct delivery

Move merchandise directly from the port of arrival to the foreign-trade zone, dramatically reducing customs clearance delays and improving speed to market.

Save time with tools that simplify compliance.

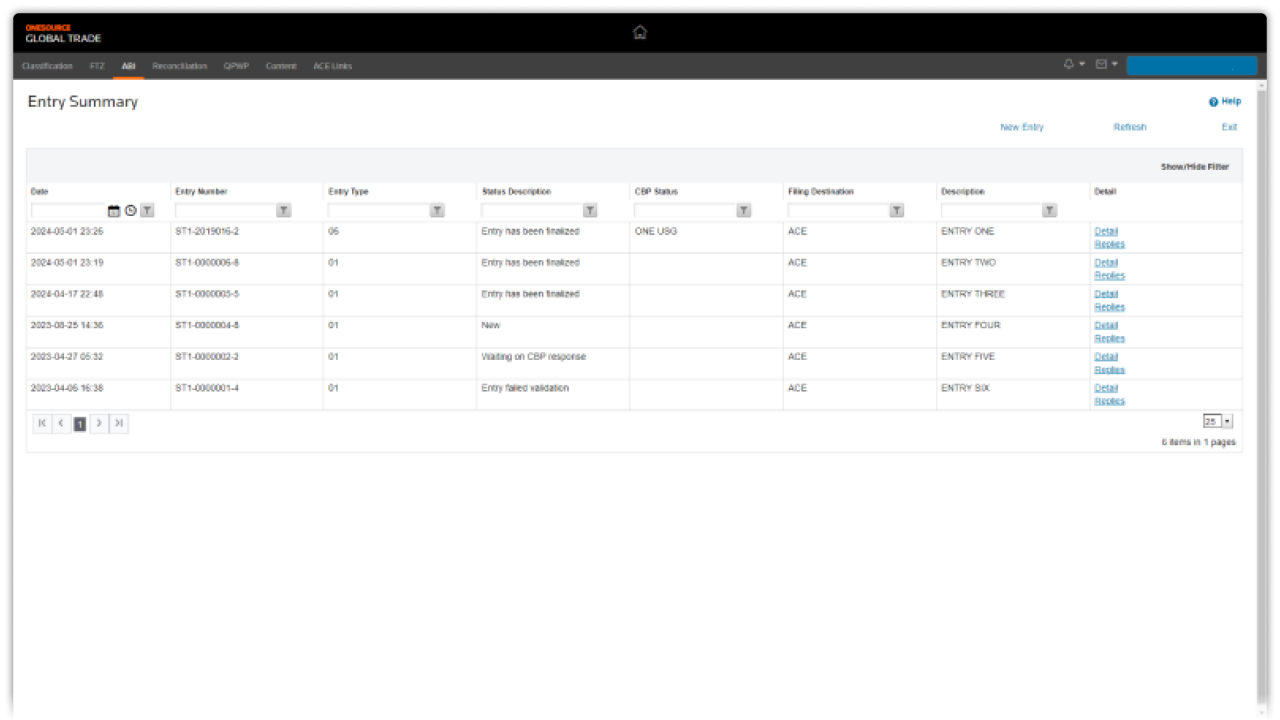

Clear communication

Efficiently interact with U.S. Customs, carriers, forwarders, and brokers for manifest information as well as entry information.

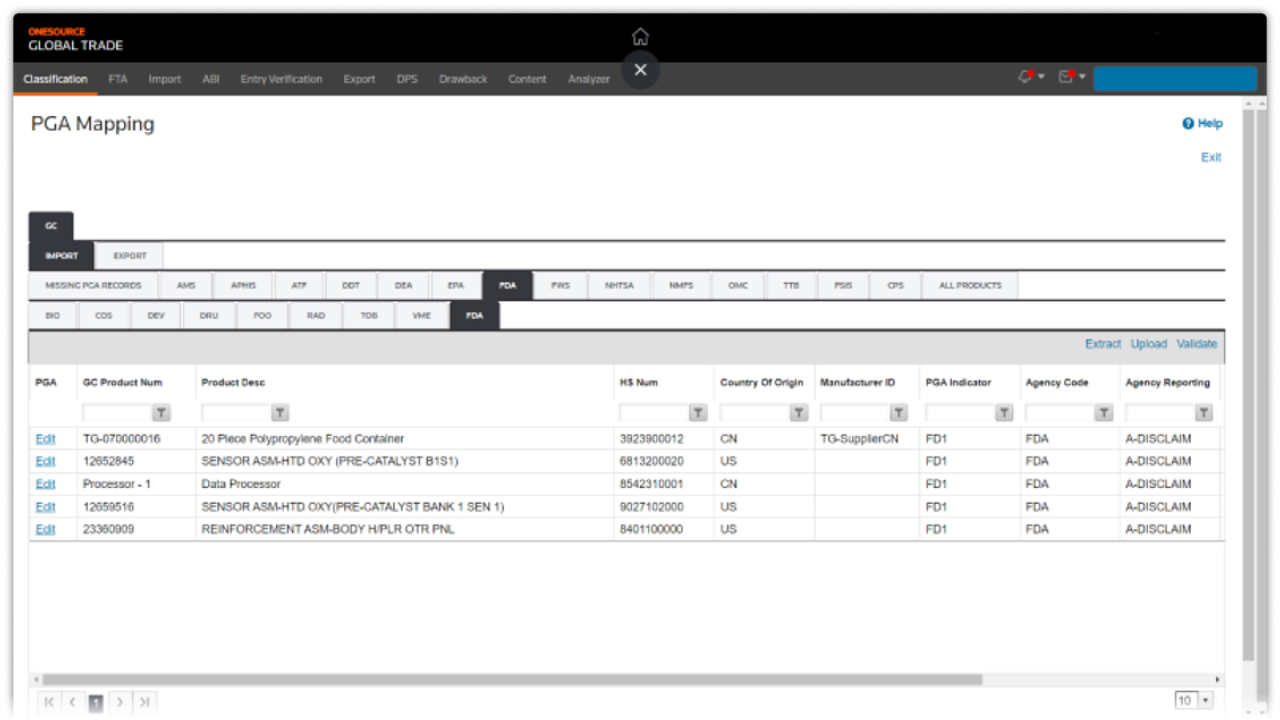

PGA Management

Maintain a centralised database of Partner Government Agency (PGA) information to ensure compliance with the various agency reporting requirements.

Validated content

Efficiently perform due diligence with a content validation process that regularly corresponds with government agencies in addressing issues in regulatory information.

Custom reporting

Simplify reporting by automating reports needed for the FTZ Board, U.S. Customs, and internal purposes.

Talk to an expert

Streamline your supply chain and reduce costs with ONESOURCE FTZ management solutions.

Duty exemption

Save money and avoid the hassle. Re-exports, scrap, loss, destruction, and zone-to-zone transfers are duty-free.

Re-exports

In FTZs, re-exporting into a foreign country is completely duty-free. If the goods never enter U.S. commerce, no customs duty is ever due.

Duty-free scrapped and destroyed goods

No duty is owed on goods destroyed or scrapped in the FTZ. For a company importing $50 million in foreign parts with an average 7.5% duty rate, that equals $225,000 in duty savings.

Supply chain integration

Transfer goods from one foreign-trade zone to another with no customs duties. By extending FTZ benefits throughout your company’s U.S. supply chain, you will lower your overall cost structure.

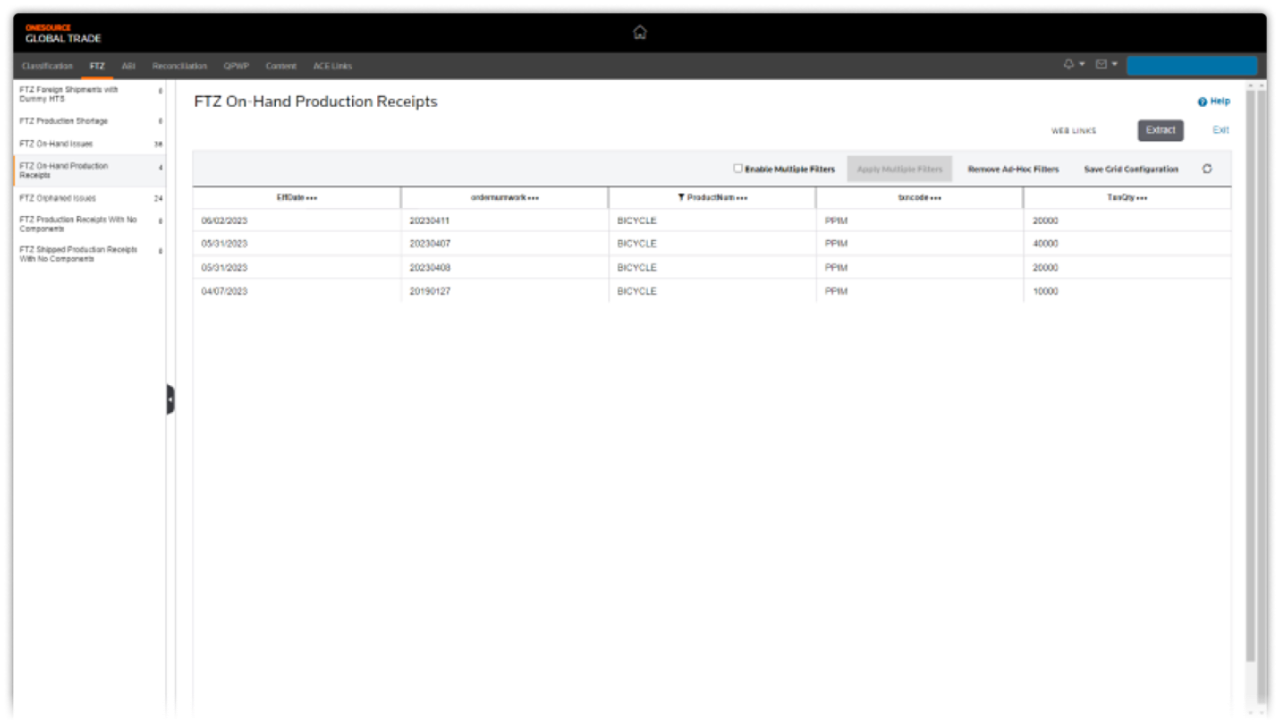

Better manage the inventory in a controlled FTZ warehouse.

Enhanced security

In a foreign-trade zone, you’re required to meet certain security standards. The good news is that most companies — and all CTPAT members — are already meeting these requirements by incorporating fences, ID cards, cameras, and more.

Indefinite storage

Benefit from foreign-trade zone indefinite storage — unlike the five-year limit on bonded warehouses. If goods require a lengthy manufacturing process, they can stay in the FTZ without duty payment until the finished goods are completed and shipped.

Lower insurance premiums

Reduce your insurance costs with FTZs. Typically, for insurance purposes, the duty amount paid on imported merchandise is included in the insurable value of your inventory.

Frequently asked questions

The software optimises the transfer of goods between foreign trade zones by automating key processes such as documentation and compliance checks. This reduces manual effort and human error, allowing for faster and more efficient movement of goods. It ensures all regulatory requirements are met, minimising delays and facilitating seamless transfers. Additionally, the solution provides real-time tracking and visibility into shipments, enhancing operational efficiency and decision-making.

The solution offers comprehensive features for managing zone operations, including advanced inventory tracking systems that ensure accurate record-keeping and inventory control. Compliance management tools simplify the process of adhering to regulatory standards, reducing the risk of penalties. Automated reporting capabilities streamline the generation of necessary reports for customs and internal purposes, saving time and resources. These features collectively enhance oversight and operational efficiency within foreign trade zones.

The software aids in reducing CBP duty payments and Merchandise Processing Fees (MPF) by enabling deferred duty payments until goods enter U.S. commerce. This improves cash flow and reduces upfront costs. It consolidates multiple shipments into single weekly customs entries, lowering MPF expenses. Additionally, the solution identifies opportunities for duty exemptions on re-exports, scrap, and other eligible activities, providing significant cost savings and optimising the financial aspects of import and export operations.

The solution provides robust support for compliance with customs regulations through a centralised database that maintains Partner Government Agency (PGA) information. This ensures all data is easily accessible and up-to-date, facilitating compliance checks. Automated reporting tools simplify the generation of required documentation, ensuring timely and accurate submissions. Real-time communication features enable efficient interaction with customs authorities, addressing any regulatory issues promptly and maintaining adherence to all requirements, thus mitigating the risk of non-compliance penalties.

Experience it for yourself

Streamline your supply chain and reduce costs with ONESOURCE FTZ management solutions.

Have questions? Contact a representative